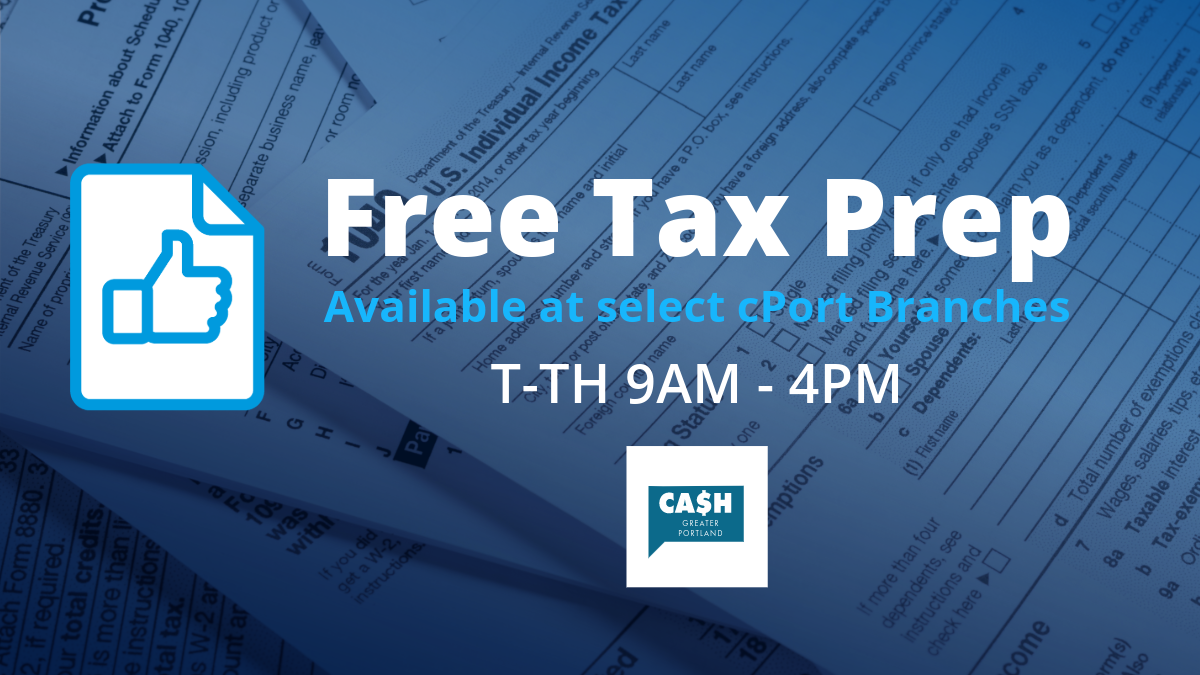

cPort employees are volunteering their time through the CA$H Maine program to help Mainers get their 2023 taxes prepared for filing for free. Our three Portland and Scarborough location scan your tax documents, return them to you, and securely submit them for an IRS-certified tax preparer to prepare your taxes at another time.

Do You Qualify?

In order to qualify for free tax preparation services, you must meet all of the criteria below.

In-Person or Virtual Tax Assistance

- Visit one of cPort's Scan & Go Sites at our Portland and Scarborough branches. Volunteers are available Tuesday through Thursday from 9 a.m. to 4 p.m.

- Start the intake process online by visiting Free tax help from IRS-certified volunteers. | GetYourRefund

CA$H Maine is a partnership of community non- and for-profit partners working together to help empower individuals and families to achieve long-term financial stability. Since 2004, They have offered free tax preparation to qualified filers during tax season; helped employers bring financial education tools to their employees; and educated hard-working families and individuals about programs in the community that can increase their income, reduce debt, and build savings. CA$H is a year-round resource, providing outreach and education about ways you can make the most of your money.